Contents:

You’ll also want to include more incremental costal or team-based questions that can help you determine if the person is a good fit with your company culture. Interview your accountant with specific skill-related questions, but also get to know them like you would anyone else. While accountants tend to have the financial knowledge required for bookkeeping, accountants provide a more strategic analysis of your business. But if you ask us, then we’d recommend getting a professional accountant involved as early as you can. It helps to start off on the right foot, and having an accountant advise you from the very beginning can save you a lot of time, effort and money down the line. Things can start off pretty smoothly at the beginning, with a limited number of business transactions to worry about.

- A competent cost accountant is by and by familiar with a particular field, thing as well as organization.

- Your accountant will also give you a sense of necessary startup costs and investments and can show you how to keep functioning even in periods of reduced or negative cash flow.

- This resource will help you develop an onboarding checklist for new hires.

- Many accountants provide specialized services, including public accountants, forensic accountants, and investment accountants.

- Size of company – Hiring an accountant for a small company is a waste of money.

Hiring an accountant can be invaluable for a business that aims to stay ahead of the curve and maintain an upward growth trajectory. This checklist covers key features you should look for when choosing a skills testing platform. If you are happy with your choice you are ready to make them an offer. Again, make sure the offer corresponds to the job difficulty, the size of the organization, and the location of your business.

What small businesses should consider before hiring an accountant

This will help you write better job descriptions and find someone who more closely matches the requirements. This person is handling some of your most important financial work, so you need someone you trust and have a good gut feeling about. Is it the main accountant, or will they be passing you off to a junior colleague? Learn more about Privacy at ADP, including understanding the steps that we’ve taken to protect personal data globally. Tap into a wealth of knowledge designed to simplify complex tasks and encourage strategic decisions across key functions.

You can evaluate candidates’ knowledge of this software with our QuickBooks Online test. This test will help you assess if the accountant applicant is proficient enough to use the software by navigating the system and using it to process key accounting information. Now you can use pre-employment tests to hire an accountant on a skills-testing platform like TestGorilla.

Businesses Under $750k

That salary can vary significantly by region, with accountants in New York and Los Angeles earning the highest average salary, at about $62,000 and $59,000, respectively. Access the diversified funds you need to make faster payments and manage your cash flow. These are only a few of the high-level responsibilities of an accountant. Depending on your business, there are likely other qualifications you’ll need in a future hire or partner. Tax preparation – They’ll need to correctly pay your business taxes on time and maximize deductions throughout the year.

Tax Season Is Coming, and These Firms Can’t Find Enough … – The Wall Street Journal

Tax Season Is Coming, and These Firms Can’t Find Enough ….

Posted: Wed, 18 Jan 2023 08:00:00 GMT [source]

Before you explore outside resources, use your connections to your advantage. Do your due diligence when investigating anyone you are seriously considering hiring. Picking the right accountant is important for your business’s financial future.

Skills and qualifications to look for in an accounting professional

One of the more significant components of recruiting an accounting team is the means by which you bring a recently added team member into your association. This is known as the onboarding experience and ought to be painstakingly enhanced to cause new representatives to feel appreciated. Recruiting a decent assessment accountant can pay for itself many times over. Additionally, they’re next to you if there should arise an occurrence of a dispute or audit.

If you’re in a good spot with your finances and mostly need help preparing for tax season, a part-time accountant who specializes in taxes is a good choice. Your bank account and credit card statements may be wrong and you may not discover this until it’s too late to make corrections. You may have no clue about allocating income to saving and investing. Or you may overlook expenses that could provide some tax benefits. An accountant will put your company’s financial records in order and produce statements of accounts that you can show to prospective buyers. Using high quality accounting software they can create useful charts and tables to show your company in a good light.

Want More Helpful Articles About Running a Business?

Not all recruiters are the same – the key to success is to find and partner with an agency that is able to understand and deliver exactly what your business needs. Access all Xero features for 30 days, then decide which plan best suits your business. Get connected with an experienced accountant in the Xero advisor directory. For example, they can check whether the company’s assets are fully owned or leased or part-paid for, and whether the company has any outstanding debt.

A Guide to Accounting Software Pricing Models – Software Advice

A Guide to Accounting Software Pricing Models.

Posted: Tue, 21 Mar 2023 07:00:00 GMT [source]

Hiring an accountant will provide you with someone who can offer sound advice on all your business’s finances. They will keep track of all your business’s financial transactions and try to keep you in the green as much as possible. At the very least, you’ll want to work with a professional who is a Certified Public Accountant or CPA. They’re also expected to understand the nuances of tax law, and can help you navigate key compliance tasks. By employing a full-time accountant to work within your business, you’re recruiting an ally whose expertise on what your business needs to stay in financial good standing will only grow over time.

Businesses must, therefore, interview and scrutinize candidates carefully. Check for experience, personality traits, and digital software expertise thoroughly. Communication at this process must, therefore, be direct and straightforward.

An experienced professional accountant can keep your finances in tiptop shape year-round and ensure that the reports and statements are accurate. They also take steps to keep accounts properly balanced in order to prevent any scrutiny from audits. Hiring an accountant to handle your finances ensures that you do not have to directly deal with any financial matters, and the accountant can help you save time and money. Accountants play an important role in supporting businesses, and they handle all financial matters from taxes to payrolls to sustain a growing business.

- With a 30-day money back guarantee you have nothing to lose… and everything to gain.

- Hiring someone who is a CPA is definitely an important consideration.

- Just make sure you hire an accountant you trust, ideally from a strong recommendation.

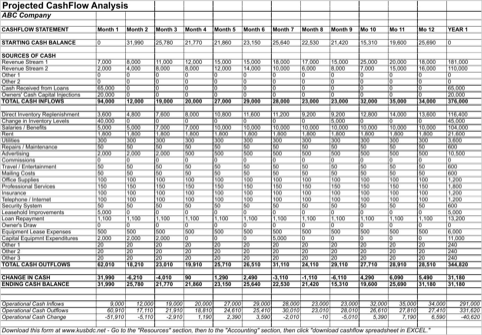

And they can produce tables and charts that will help you https://1investing.in/ your company’s current financial situation at a glance. This will help you monitor the pulse of your business and keep track of important things like cash flow. Ensure any potential accountant or accounting firm offers year-round services. Year-round services track your finances and will be more effective at tax time while maintaining accurate financial reporting and supporting quality decision-making.

Even then, the cost can vary widely based on where you live and the level of experience they have. Auditing services that include constructing your business’s financial statements from scratch, or conducting an audit for loan purposes are all taken care of by accountants. Often auditors are thought of as the outside accountants assessing the quality and accuracy of the financial statements.

I’m a Financial Planner, and I Hired an Accountant to Do My Taxes – Business Insider

I’m a Financial Planner, and I Hired an Accountant to Do My Taxes.

Posted: Thu, 23 Feb 2023 08:00:00 GMT [source]

Use the information above to define exactly what you need – soft skills, hard skills, communication, honesty. Anything you feel is important for your business should be written in the job description. You need a clear idea of what needs to be done in your business and how much work you’re willing to hand over to your accountant.